Participate

Introduction to Currencies

Currency Pattern Language

Deeper Resources

About This Site

Additional pages to Archive

This home page (below)

- Stones, Tumbles, & Gems

- Dimensions of Incentives

- Principles of Flow

- Biomimicry Patterns

- Eschelon

- Market

- Glossary

- Wealth_Acknowledgment

- Communities_of_Engagement

- Sign

- Feast_and_Famine

- Naming_and_Binding

- Binding

- Membrane_Technology

- Beyond_the_Commons

- conventions

- Open_POS

- Towards_an_open_economy_manifesto

- Levels_of_Wealth

- Open_Money

- Currency_Guild

- Ontology_Metadata_and_Semiotics

- Wealth_Literacy

- Milk_n_Honey_the_movie

- Emergence

- Currencies_as_Records_of_Currents

- Challenging_Assumptions

- Weal

- flow_centric_model_of_reality

- Open_Letter_to_Builders_of_the_New_Economy

- Writing_Together

- CEN_PDX_Plan

- Sourcetree

- New_Expressive_Categories

- WealthMapping

- What_is_a_currency

Welcome to New Currency Frontiers -

Resources for Builders of the New Economy

A New Vision for the Future and for Humanity

We invite you to explore innovative interpretations of money, economics and society which are resulting in a new way of thinking about our future. You will find pieces of the puzzle on this web site to understanding the next economy.

It is a work in progress, so it may not be clear and cohesive, but if you are open to some new ideas, you will find both practical tools and inspiring visions.

Please take two minutes read this page. Then share the questions that emerge for you.

The New Frontier

Free Speech laws are designed to protect public discourse and dialogue. They create a safe space for a sort of "idea commons." However, there are no such protections for a "value commons" where communities and people can choose what they value and how to measure its value.

We have laws to protect freedom of speech and provide a safe space for the idea commons, but what creates the space for a value commons?

Open Currencies

The new frontier is about open currencies which do not exist by mandate of banks or government.

Modern computing and communication technology enable us to replace the role that banks have played in accounting, enabling transactions and ensuring data security. Additional platforms we've developed enable us to do all those things without a centralized server or database.

The result is systems which cannot be shut down by external forces. As long as there are people who want to use them they can continue to function through a completely peered architecture.

What We Mean by Currencies

We are not using the word currency in the everyday sense where it is equivalent to money. We're expanding its meaning because of its original roots from the Latin "currere" meaning to run or flow. In this expanded sense, currencies are tools for seeing and changing flows.

Currency:A formal symbol system for shaping, enabling, and measuring currents (or flows)

Money is clearly a currency since we use it to facilitate flows of goods and services and to measure and record those flows. Other currencies include bus passes, Olympic Medals, college degrees (as well as the credits and grades used to get one), certifications, eBay reputation ratings, movie tickets, postage stamps, etc. We use scores of them every day.

One specific way we use them is to create collective intelligence at the level of our social entities and institutions. At the individual level, we see humans born, growing, learning, walking around and dying. However, the state "sees" humans created through birth certificates, their activities and accounts woven together by social security numbers, their communication patterns via cell phone bills, and their discorporation via death certificates.

The New Economy

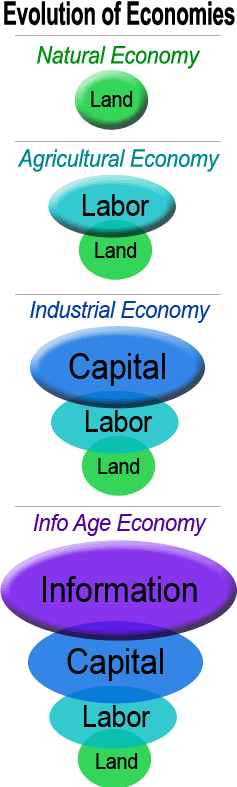

Today we face disruptive economic transformation. We pretend it is just another downturn or recession on the same trajectory that we've been on for 100 years because it is just too uncomfortable to face the fact that all the rules are changing.

The crux of the decision you need to make is: Will you cling to the familiar yet dying paradigm of the Industrial Age? or... Do you have the mental flexibility to consider completely new models so you can succeed in the emerging era?

If you choose to move forward, you will discover that you will need to re-examine many things that you may have come to believe are true. Even if those things were true for an industrial economy, they may not be for an information economy.

Example: In Industrial Age Economics, scarcity was king. Scarce money. Scarce facilities. Scarce resources. Market pricing revolved around this principle. Governance and management were based on it. All current economic theories reflect it.

However, information operates in a fundamentally different way. Information assets actually INCREASE IN VALUE as they are shared. If I have a factory tooled up for manufacturing carpet, then you cannot use it to manufacture cars at the same time. Yet both those factories can use the same accounting software (an information asset), time clocks, safety training classes, quality management methods, communication protocols, etc.

Just think of how worthless the first email software was. There was nobody else to send messages to or receive them from. But as acceptence of this protocol spread, and millions adopted it, email grew in value. This principle completely turns traditional economics on its head.

That radical shift from scarcity is barely the beginning of the new picture...

What You Can Do

- Ask Questions: Talking about the new economy usually triggers a healthy mix of fear, excitement and curiousity in people. What burning questions do you have about what happens next?

- Spread the Word: Do you know other people who you want to engage in this dialogue? Start talking with them about it. Have them read this brief introduction. Convene a discussion group. Talk about it. Blog about it. Tweet about it.

- Invent Answers: This is new territory. We don't have a monopoly on the insights about how the massive shift in the underlying ingredience of our economy will play out. Share your ideas. Tell your stories. Help cast light on this mysterious new terrain.

- Use Our Tools: Explore using new currencies in the flowplace. Look at how they could be useful in your life, your business and your community. Need a babysitting exchange? A tool library? A network of trusted advisors? Implement them where they'll provide value. Get others using them with you.

- Help Build the "Open Source" Economy: We're building the core platforms and protocols for open currencies and a value commons at the Metacurrency Project. If you're a programmer, geek, tester or power user, come help us.

- Paint a Picture: In images, dance or words... Help us paint the picture of a world with a rich ecosystem of currencies which honor many kinds of value. If you didn't have to spend most of your time and energy just trying to keep up with bills in a hamster-wheel-economy, what real value would you be contributing?

- Contribute: During this transitional phase between economies. Those of us working on the platforms and systems for the next economy still need to keep the bills paid in the old economy. Hurry up and translate current financial assets into a useful foothold in the next economy, because those gems left on the sunken ship won't be worth much.

The Coming Currency Revolution

A recent Wall Street Journal Video which includes us.